Ofgem Launches Price Cap Consultation Part 1 : Outlook for October 2022

This morning, Ofgem announced the launch of a statutory consultation on proposed changes to its Price Cap wholesale methodology. The consultation addresses the Price Cap index, including the length of the notice period such that there may now be four Cap Price adjustments per year. The consultation also contains a proposal to update the wholesale methodology to include backwardation. The deadline for responses is Tuesday 14th June 2022.

The consultation document and supporting material can be found at :

Price cap - Statutory consultation on changes to the wholesale methodology | Ofgem

Given the major contribution of energy prices to the cost-of-living, all eyes will be on Ofgem as it prepares to announce the new domestic energy Price Cap for October 2022. However, it seems most unlikely that this consultation will impact upon the October 2022 Cap Price, as we are already two-thirds of the way through window during which wholesale prices are captured before being fed into the averaging calculation.

October’s official announcement on October is not due until early-August, but it is possible to forecast the level of the October Price Cap using available data under the current Ofgem methodology. In Part 1 of this Blog, we venture an opinion as to what the October Price Cap could be, assuming no changes to the duration of the window.

Back in February, energy consumers and pressure groups were shocked when Ofgem announced a steep increase in the Cap from £1,277 to £1,971. Up until that point, the Price Cap had been relatively stable, and energy suppliers had managed to keep their tariff prices well below it.

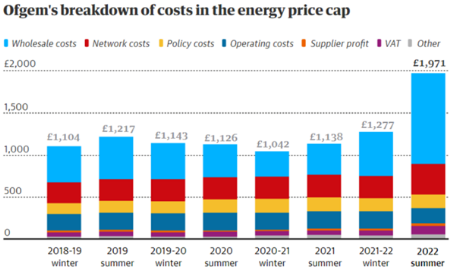

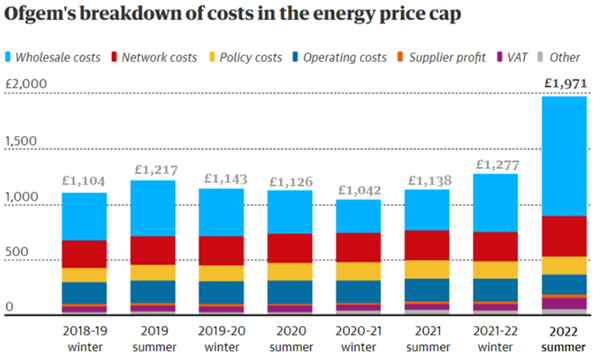

The following chart shows the Price Cap’s history since its inception in 2018, taken from the Ofgem website :

The relative contributions of energy and non-energy cost components to the Price Cap can be seen in the above chart.

It can be seen that the biggest driver of the April 2022 Price Cap increase was the dramatic rise in wholesale energy costs (blue on the chart). These costs had doubled, from around £500 to over £1,000, far outweighing all the other cost increases combined. Furthermore, wholesale energy prices are set globally, beyond the control of any single national government, and highlighting the fundamental fault-line over which the UK and European deregulated energy markets are built.

So, what is the outlook for the October 2022 Price Cap?

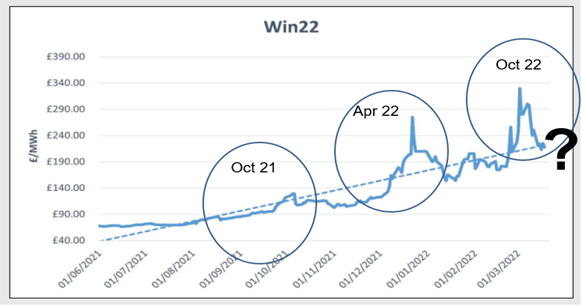

Ofgem’s current calculation takes an average of wholesale energy prices over a six-month period ahead of the start of the Cap. For October 2022, this means capturing prices from February through July. This timelag approach is intended to protect consumers from price spikes, but at the same time, it fails to pass on the benefits of price collapses.

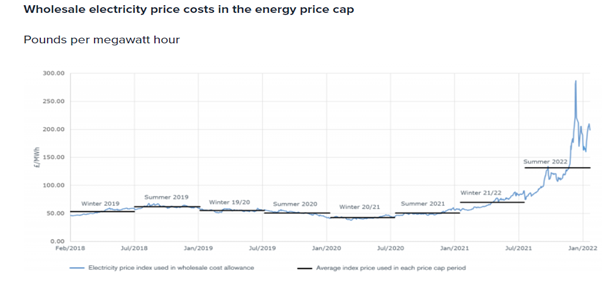

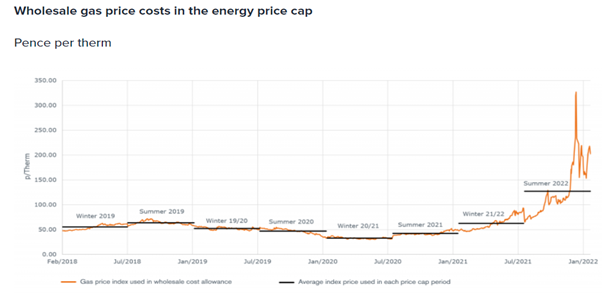

The following Ofgem graphs for electricity and gas prices illustrate this point :

The reader can see from the Ofgem graphs that over the period 2018 – 2021, average prices (marked as black lines) used in the Cap were fairly stable, but from July 2021, the averages increased, causing the April 2022 price-hike. Rolling these graphs forward into Q1 2022 does not offer many grounds for optimism :

The February/March price-spikes resulting from the Russian invasion of the Ukraine look set to lift average wholesale energy prices well above those used in calculating the April 2022 Price Cap. Even taking recent price falls into account, Ofgem’s averaging methodology has locked in an increase.

Matrica’s replicates the Ofgem methodology, and our latest forecast for the October 2022 Price Cap is £2,395, nearly 20% higher than April. This is not as high as some have predicted, mainly because we have used prices up to 10 th May which have clearly fallen back from their earlier peaks. Given we are nearly two-thirds of the way through the averaging period, there would have to be a prolonged price move up or down to shift the average much away from this value.

Our forecast will not be of much comfort to domestic energy consumers and politicians, as it implies that energy poverty is still likely to get worse before it gets better. It will be some time before wholesale energy prices return to a level which lowers the average that in turn lowers the Cap, if they ever do. Nor will our forecast be of much comfort to energy suppliers, who may already have hedged their October-start energy volumes at prices around February/March levels, and could have locked in a loss as soon as Ofgem sets the October Cap on the basis of a lower February - July average.

There has been talk on what the government and Ofgem can do to mitigate October’s expected rise, including the scrapping of the Green levies and a suspension of VAT. It’s clear from Ofgem’s cost-breakdown charts above that suspending either or both will make little difference to the final price to energy consumers. However, suspension of the Green levies could do lasting damage to the drive to renewable energy. The UK may have a low sensitivity to Russian gas, but certainly not a low reliance to global gas. Another ‘dash-for-gas’ could invite climate disaster, so an accelerated switch to renewables has to be the right way forward.

Other government options involve imposing a windfall tax on energy producers. In reality, this may prove hard to impose on the big multinationals with highly mobile tax domiciles, and on integrated companies operating both energy production and retail businesses who can use transfer pricing to move profits and tax liabilities around.

In Part 2, we’ll publish our initial thinking on the impact of Ofgem’s proposed changes to the methodology to the level of the Price Cap.